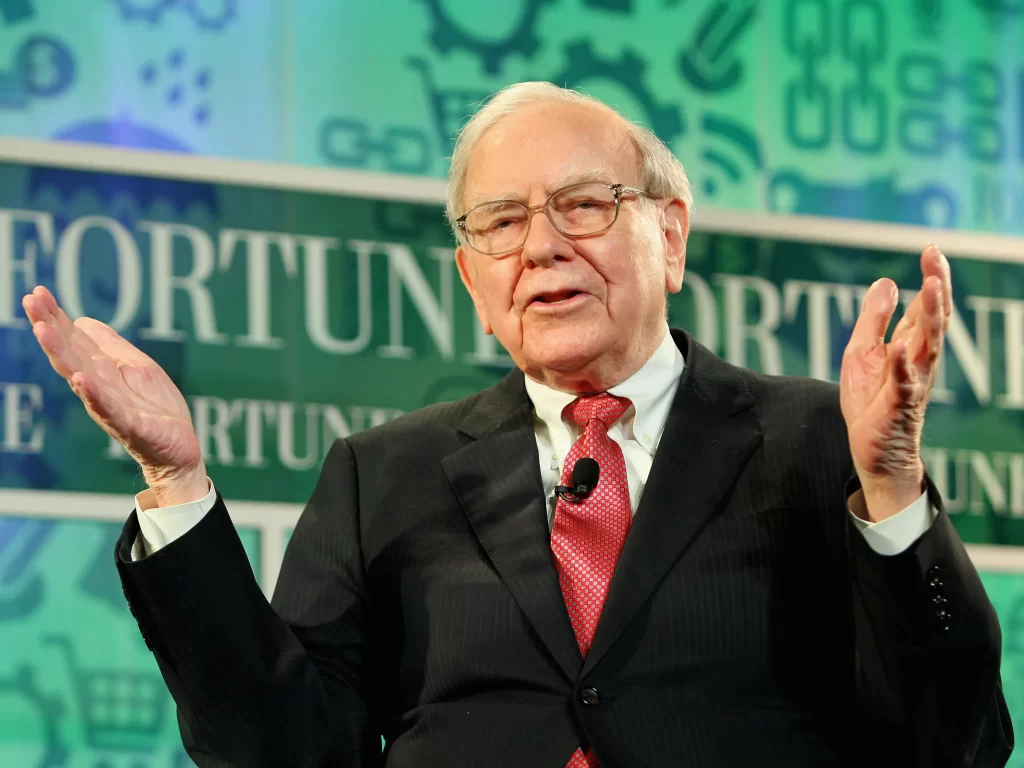

Berkshire Hathaway Inc, led by Warren Buffett, increased its stake in Apple by acquiring an additional 20.8 million shares for $3.2 billion. The corporation now has a 5.8 per cent ownership from Berkshire Hathaway.

The disclosure comes almost three months after Berkshire said it had purchased TSMC stock worth more than $4.1 billion. Moreover, Louisiana-Pacific Corp., a manufacturer of building materials, received a fresh $84 million investment from Berkshire.

After cutting its interest in several banks and Taiwanese contract chip maker Taiwan Semiconductor Manufacturing Co Ltd (TSMC) in the fourth quarter, Berkshire Hathaway increased its ownership of Apple shares. The stock holdings of Warren Buffett’s firm in TSMC were reduced by 86.2 per cent to 8.29 million.

“On TSMC, Berkshire generated a little profit. Not a massive, massive victory for Berkshire, “Cathy Seifert, an analyst at CFRA Research, told.

The disclosure comes almost three months after Berkshire said it had purchased TSMC stock worth more than $4.1 billion. Moreover, Louisiana-Pacific Corp., a manufacturer of building materials, received a fresh $84 million investment from Berkshire.

The Taiwanese business manufactures semiconductors for customers, including Qualcomm Inc. and Nvidia Corporation. Apple only receives bespoke processors from TSMC.

Also, Buffett’s conglomerate has stock in several well-known global corporations, including Citigroup Inc., Bank of America, and Jefferies.

Also, Berkshire reduced several of its holdings in its portfolio of US-listed businesses, including Activision Blizzard and Chevron. Microsoft Corporation is presently attempting to acquire Activision Blizzard.

Apple’s stock has increased by over 18% so far this year.