On Wednesday, Aditya Birla group firm UltraTech Cement Ltd, the largest cement manufacturer in India, reported a 42% decline in its consolidated surplus after tax (PAT) at Rs 756 crores for the quarter ended September 2022, as against Rs 1,314 crores in the year-ago quarter, weighed down by higher power and fuel costs as well as lower sales.

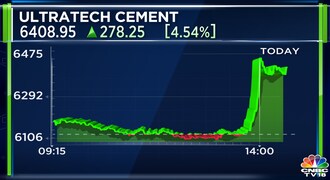

Ultratech Cement is plunging as its Q2FY23 net profit falls 42.5% YoY to Rs 756 crore however, net sales grow by 15.8% YoY. The company also reports an increase in raw material costs, energy costs, and logistics costs in Q2. Its net debt also increased by 32% YoY. The company shows up on the screener listing stocks with declining net profit and profit margin.

READ ALSO: ZEE Entertainment climbed 6.2% amid Rs 1,396 crore block deals

Demand was low during July and August but showed some signs of revival in September, the company said in its earnings release.

The pick-up in retail demand was on the back of pent-up demand accumulation during the monsoons, pre-Diwali construction and repair work gaining momentum, and pre-election tailwinds. Institutional demand was led by increased construction activity after the receding monsoons.

Reason for the decline in demand

The key reason for the decline in profits was the lower realization and higher energy costs that weighed on the operational performance. Institutional need according to UltraTech was led by growing construction activity after the receding monsoons.

Despite monsoon rains, UltraTech’s domestic sales volume grew 9.6% on-year during the quarter. Energy costs, which constitute 37 percent of operating costs for the company, increased 58 percent on year to Rs 1,731 per tonne. The increase was due to a rise in blended fuel prices of $200 per tonne as compared to $120 per tonne during the same period last year.

The consumption of pet coke was 40 percent during the quarter compared to 19 percent a year ago. Raw material costs rose 18 percent, YoY to Rs 610 a tonne and constituted 13 percent of the total operating costs.

MUST READ: Byju’s raises $250 million from existing investors, laying off 2,500 employees